Documents to gather:

All documents showing either 1) ownership or 2) other roles that have the ability to make changes, investment decisions, etc.

- Do you have a trust or powers to control an entity? Grab those trust documents.

- Do you have entities that own entities? Grab those LLC docs and any amendments or side agreements.

- Formation documents for any entity that does not meet the exemption.

- You’re going to need the entity tax ID; grab the IRS letter.

- Every person who meets the “qualifications” as a control person or having an ownership interest will need to upload a copy of their driver’s license or passport.

Keep in mind, a beneficial owner is ANY individual who, directly or indirectly:

- Exercises substantial control over a reporting company;

OR

- Owns or controls at least 25 percent of the ownership interests of a reporting company.

Keep in mind, a reporting company can have multiple beneficial owners!

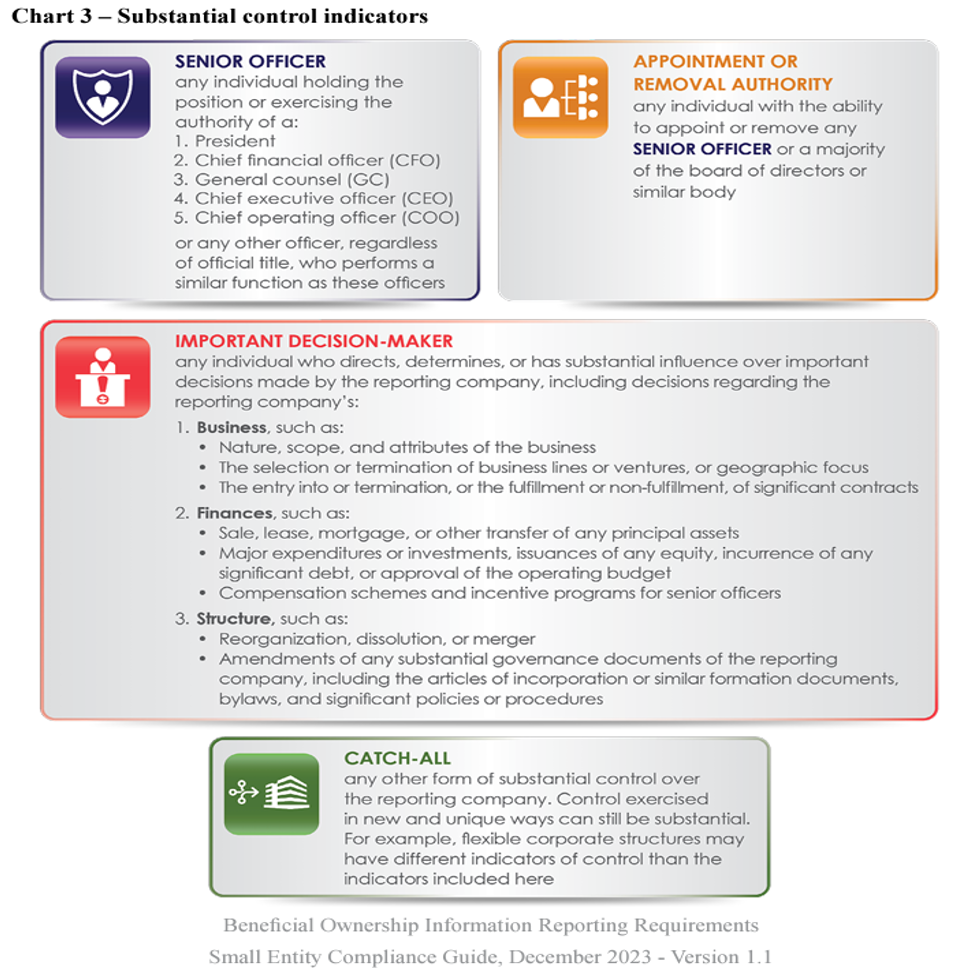

What is Substantial Control?

Reporting companies are required to identify all individuals who exercise substantial control over the company. There is no limit to the number of individuals who can be reported as exercising substantial control. An individual exercises substantial control over a reporting company if the individual meets any of four general criteria: (1) the individual is a senior officer; (2) the individual has authority to appoint or remove certain officers or a majority of directors of the reporting company; (3) the individual is an important decision-maker; or (4) the individual has any other form of substantial control over the reporting company.

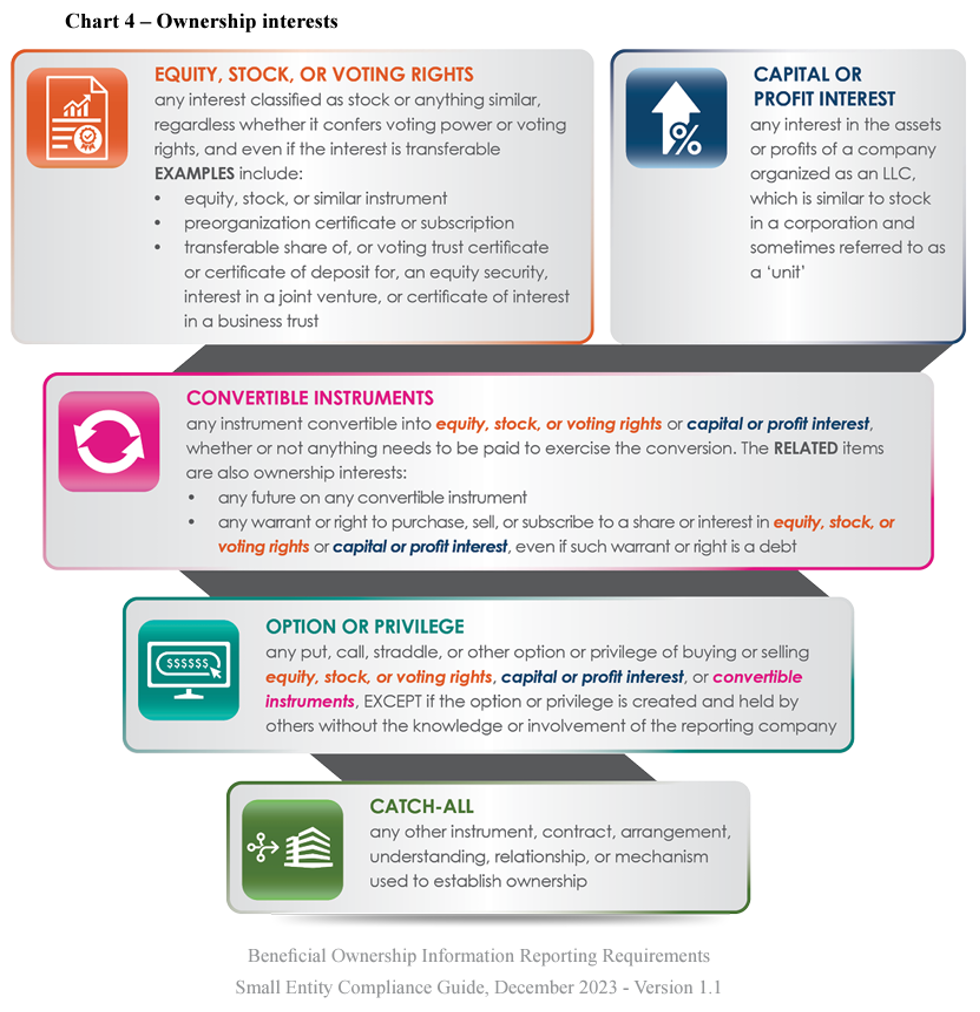

What is Ownership Interest?

Reporting companies are required to identify all individuals who own or control at least 25 percent of the ownership interests of the company. Any of the following may be an ownership interest: equity, stock, or voting rights; a capital or profit interest; convertible instruments; options or other non-binding privileges to buy or sell any of the foregoing; and any other instrument, contract, or other mechanism used to establish ownership. A reporting company may have multiple types of ownership interests. The following chart identifies the ownership interest types and provides examples.

The full document detailing the Corporate Transparency Act can be found here on the Fin CEN website.