The organizational structure, setting, and business model of an advisory firm that delivers services to UHNW families.

Professionals serving UHNW clients provide services within a wide variety of business models and settings that impact the delivery of those services. Each has its own type of ownership, leadership/management model, compensation structure, service focus, capital structure, regulatory compliance requirements, clientele, and firm culture, operating in particular jurisdictions and with varying purposes and goals. The business model through which professionals practice their trade influences service delivery to an important degree, including the extent to which services may be integrated or kept separate.

Classifying financial or related business entities into a straightforward set of categories is harder than might appear. Some common types of firms providing services to UHNW clients include the following:

The value of all assets for which an advisor is paid to provide investment or other financial advisory services without discretionary authority to implement transactions involving them.

In providing services for assets under advisement (AUA) a firm serves as a fiduciary, with its fiduciary duties determined by whether it is acting as an investment adviser, trustee, or other type of advisor. Those services may be defined in an investment advisory agreement, trust agreement, financial services agreement, or other governing document, subject to restrictions or guidelines in an investment policy statement or similar arrangement between the firm and the owner of the assets.

A firm’s AUA is distinct from its assets under management (AUM). AUM are assets for which a firm is paid to provide continuous and regular investment management services with authority to use its discretion to implement transactions involving them.

AUA and AUM services are provided by various types of firms subject to different regulatory oversight and reporting requirements, including registered investment advisers (RIAs), broker-dealers, banks, public trust companies, private trust companies, and single-family offices.

When comparing AUM or AUA for different types of firms, it is important to obtain explanations of how each firm calculates these amounts. Some firms include AUM in their calculation of AUA without making it clear they are doing so, while others report AUM and AUA separately. To address this problem if these amounts are being evaluated, firms should be asked to explain how they calculate their AUA. If they include their AUM in that calculation, they should be asked to report the amounts separately.

The value of all assets an advisor is paid to manage on a continuous and regular basis, having discretionary authority to implement transactions involving them.

For assets under management (AUM), the advisor or firm serves as a fiduciary, with its fiduciary duties determined by whether it is acting as an investment adviser, trustee, or other type of advisor. The firm may or may not be required to consult with the owner of the assets or another party before exercising its discretion to manage the assets.

Authority over AUM is provided by and defined in an investment advisory agreement, trust agreement, financial services agreement, or other governing document. It may be subject to restrictions or guidelines in an investment policy statement or similar arrangement between the firm and the owner of the assets.

A firm’s assets under management are distinct from its assets under advisement (AUA). AUA describes assets for which a firm is paid to provide advisory services, but either those services are not continuous and regular, or the firm does not have the authority to use its discretion to implement transactions involving them.

AUM and AUA services are provided by various types of firms subject to different regulatory oversight and reporting requirements, including registered investment advisers (RIAs), broker-dealers, banks, public trust companies, private trust companies, and single-family offices.

When comparing AUM or AUA for different types of firms, it is important to obtain explanations of how each firm calculates these amounts. Some firms include AUM in their calculation of AUA without making it clear they are doing so, while others report AUM and AUA separately. To address this problem if these amounts are being evaluated, firms should be asked to explain how they calculate their AUA. If they include their AUM in that calculation, they should be asked to report the amounts separately.

The process of working with other advisors and/or family members on a project, usually to serve a client’s best interests.

UHNW clients commonly require collaboration among advisors, consultants, and other professionals to adequately address the Ten Domains of Family Wealth. Effective collaboration involves facilitating the flow of information, sharing ideas and proposals, and developing solutions or plans. Multigenerational families who share assets and/or goals also typically need to be able to collaborate well within the family itself. Collaborative behaviors and skills can be enhanced and developed through training, coaching, and experience.

Acting collaboratively is considered the intermediate of three levels of group functioning on behalf of a client. The most basic level – cooperation – involves the willingness and skills to exchange information or perform an action upon request from another professional or the client. Cooperation is largely transactional and task-specific. Collaboration is a more extensive set of processes that work toward a project goal. It is specific to the situation or project and may not necessarily extend to other clients or projects. Collaboration is a fundamental building block of but not synonymous with integration.

The highest level of group functioning – integration – typically requires additional elements. These include shared goals, accountability, system support, effective leadership, and facilitation of group activity on behalf of the client. Integration has also been considered more of a mindset, a consistent approach within a firm or system. Collaboration tends to be ad hoc to a situation.

The process of creating financial statements for clients that combine data from multiple investments, accounts, and/or assets to provide a clear picture of the client’s overall financial position.

Consolidated reporting aggregates, cleanses, integrates, and tailors a client’s financial data to provide accurate reliable information for monitoring and decision-making. Compared to getting multiple account statements with different formats, metrics, and analyses, consolidated reporting allows a firm and its clients to track such portfolio metrics as liquidity, cash flow, rates of return, risk parameters, gaps in coverage, debt types and levels, net worth, and other factors related to the complexity of wealth and ownership.

The process of consolidated reporting (also sometimes called aggregated reporting) depends on back-office processes that gather data from external sources and seamlessly integrate information into customized reports for the client. This function may be as time-intensive as creating spreadsheets by hand or as sophisticated as using AI-enhanced technology to collect, integrate, and display data in whatever format the client requests. It may be a function performed internally by a client’s primary financial advisory firm or outsourced to a specialist service provider. Consolidated reporting also increasingly is designed to be available on demand in multiple digital formats.

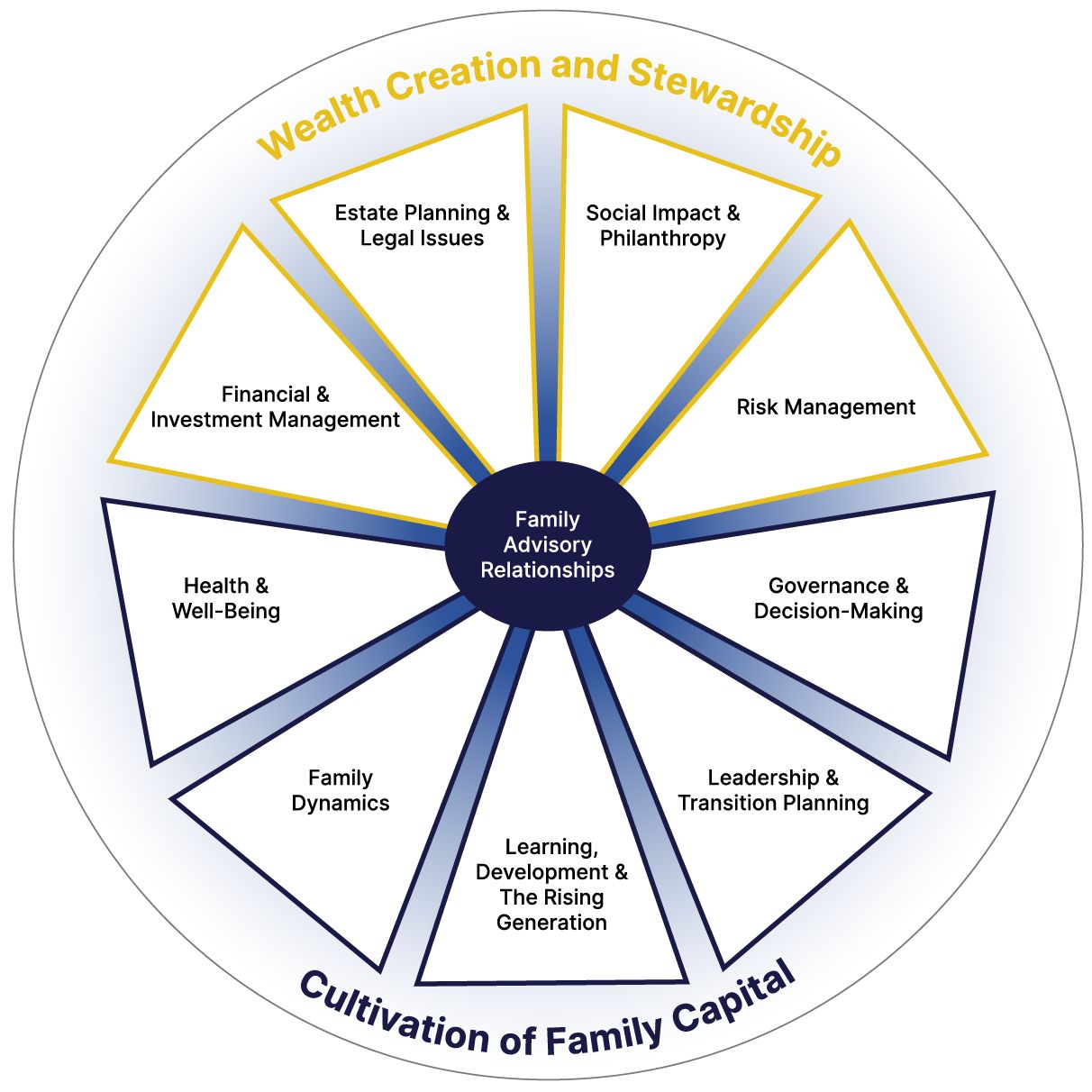

One of two clusters of domains in the Ten Domains of Family Wealth model of The UHNW Institute. The five components of this cluster include the following:

The Cultivation of Family Capital cluster contains those domains that, in addition to the Family-Advisory Relationships domain, more generally pertain to the needs of the family in nonfinancial and nontechnical areas. They have been compared to capacities of the family using such terms as intellectual capital, human capital, social capital, and spiritual capital, though the domains do not correspond exactly to those concepts.

An area of needs for a family of wealth relating to their family enterprise and/or life with wealth. Also, a professional area of discipline focusing on a particular area of expertise and services.

UHNW families are complex systems in which the needs of the family over time may be distilled in core areas or domains. Each domain represents a closely aligned set of needs for which a family will require attention, services, and support over the lifespan of family members. Each domain also represents a specialized area of knowledge and skills to serve those needs by experienced professionals.

The Ten Domains of Family Wealth model of The UHNW Institute offers a comprehensive framework for understanding the issues and needs facing UHNW families. The domains might be thought of as akin to primary colors with relatively pure characteristics. However, most real-world activities and topics that arise for families and service providers are a blend that draws from multiple domains, i.e., they are cross-domain topics. For example, issues related to mental incapacity in an elderly family leader with dementia may draw upon domains involving health, legal, family dynamics, financial, risk, governance, and leadership elements. Effectively integrating the needs of the family and the services by advisors in a given domain may be a central goal of family wealth management.

The set of abilities involved in understanding, managing, and utilizing one’s own emotions as well as understanding and responding to the emotions of others effectively and constructively.

Emotional intelligence (EI or EQ) involves several major competencies: self-awareness and effective self-management of one’s emotional states and experiences, plus awareness and interpersonal skills for understanding and working with the emotional states and experiences of others. Other competencies that have been attributed to emotional intelligence include empathy, good social skills, good motivation, and the ability to tolerate and manage strong emotions. Emotionally intelligent individuals can use these competencies to read social cues, adapt to changing environments, and build strong relationships with others.

Family wealth advisors demonstrate EQ by effectively regulating their reactions and responses to the emotions exhibited by family members and other advisors. This process can involve asking open-ended questions, using active listening and reading nonverbal signals, expressing understanding verbally and nonverbally, and providing emotional support. Emotionally intelligent advisors exhibit a positive attitude, are able to communicate effectively, take responsibility for their mistakes, and handle criticism maturely.

The structures, processes, and documents that relate to decision-making on the enterprise side of a family enterprise system.

In a family enterprise, there are essentially two major systems or pillars for governance and decision-making: family governance and enterprise governance.

The enterprise side of a family enterprise consists partly of any family businesses or operating companies that may be present which provide substantial financial and nonfinancial benefits to the owners and family. Although a family business or operating company is often present, it is not required in a family enterprise. The enterprise side also may include real estate, business and non-business investments, private equity and debt, shared assets and collections, family offices, foundations, trusts, and private trust companies.

Enterprise governance structures often include owners’ councils or boards, shareholder agreements, buy/sell agreements, boards of directors, holdings boards, and policies and procedures for family office operations. Ownership status is relevant in enterprise governance while it may not be in family governance. In enterprise governance, the owners or shareholders have an overall fiduciary responsibility for some combination of a family office, holdings board, board of directors, corporate management, investment committees or managers, and the enterprise assets themselves.

In a well-known framework known as the “four rooms model” by the BanyanGlobal consulting group, family enterprise members often need to understand what types of decisions are being made for specific issues, since roles and issues often overlap. Knowing “what room of the house you are in” helps bring clarity. BanyanGlobal advises members to consider whether enterprise governance decisions are being made in the owner room, the board room, or the management room. Issues and decisions in the family room are more likely part of family governance.

Well-designed governance systems keep the responsibilities, boundaries, structures, and procedures clear and well-defined for each major element.

The client-centered estate planning, wealth transfer, and family law services, including related tax strategies and activities, that support and protect an UHNW family and its family enterprise entities.

The Estate Planning and Legal Issues domain encompasses the myriad activities required in managing the complex estate planning, trust design and administration, family law, and family litigation activities and needs of the family and its multiple enterprises and entities, within and across jurisdictions. This domain also includes those aspects of tax planning and management that pertain to wealth transfer; legal aspects of financial, investment, and enterprise management; and legal aspects of governance and leadership roles and responsibilities across the family enterprise. The domain touches on or must be considered in nearly all activities or topics that arise in the life of a multigenerational UHNW family. It is therefore a key component in providing integrated family wealth management services.

Because of the domain’s breadth and depth, a family may utilize multiple attorneys at any given time in various roles and activities. The family office must also rely on competent counsel to ensure the family and family enterprise are well-protected and carefully administered. In addition, families with a global presence must have excellent legal advice and representation in multiple jurisdictions. Legal professionals who serve UHNW families typically have not only a greater depth of knowledge but also a broad range of skills that support excellent collaboration and interaction with family members and other advisors.

The Estate Planning and Legal Issues domain is a component of the Wealth Creation and Stewardship cluster within the Ten Domains of Family Wealth model of The UHNW Institute.

A wealth advisor with broad knowledge and skills, beyond their original professional training, who is able to act as an integrator and team leader for service delivery for an UHNW family. Expert generalists typically have knowledge of multiple technical and family areas needed by clients as well as skills for integrating those services and the work of other advisors.

The expert generalist – also termed an integrated family wealth advisor – is a dedicated role that goes beyond specific technical disciplines in UHNW wealth management. The role puts the client family’s goals and objectives first, with true client-centered services. The advisor ensures that all specific disciplines are responding to and integrated with those goals and that the family’s best interests are being consistently met. Furthermore, the expert generalist “connects the dots” across disciplines in a way that no provider of a single area of expertise can do. The expert generalist tries to anticipate how one decision might affect another and that the implications of one activity are understood and incorporated in others.

Ideal attributes of an expert generalist include strategic thinking, emotional intelligence, resourcefulness, excellent communication and collaboration skills, and a good cultural understanding and fit with the family being served. The person must be grounded in an advisory firm and role that supports being strongly aligned with the family’s interests.

The many connections, skills, and interactions between client families and their advisors that rely on collaborative, empathic, high-quality procedures. One of the Ten Domains of Family Wealth from The UHNW Institute.

The Family-Advisory Relationships domain encompasses the many generalist, cross-domain activities and needs of the family pervading interactions with its various advisors and advisory teams. These include the quality of the communication, relationship, collaboration, and integration activities that benefit the family.

Examples of essential advisory skills include excellent interviewing and discovery techniques, empathic communication (e.g., use of active listening), ability to explain complex topics in understandable ways to clients with modest technical knowledge, interaction with multiple family members at one time on stressful topics, and ability to interact comfortably with a wide range of family members. The quality of family members’ interactions naturally impacts family-advisory relationships, with more knowledgeable and socially-adept clients contributing to the success of the client relationship.

The domain is also where optimal higher-level service delivery occurs in advisory firms focusing on integrated family wealth management. Advisors in integrated advisory hubs must possess extra skills for coordinating and integrating services within and across the Ten Domains of Family Wealth, including services by specialist service providers in collaboration with the integrated hub. The skills of expert generalist or integrated family wealth advisors or teams are necessary for this level of service.

Although family wealth professionals enter the field through one or more content domains, all UHNW-capable advisors need to be expert in the Family-Advisory Relationships domain at either the essential or optimal level.

A gathering of an extended family system for multiple purposes related to growing, maintaining, and managing a family enterprise and its legacy.

In family enterprise governance, a family assembly is the planned gathering of the collective family to fulfill various goals and activities needed to maintain the family and its enterprise.

Family assemblies often have the following characteristics:

Family assemblies may occur once or with regular frequency determined by the family, its bylaws, and special circumstances.

In family governance, family assemblies typically represent all or most of the family while a family council is a smaller executive board, functioning on behalf of the entire family.

A charter or governance document written by a family that summarizes its mission, membership, structure, policies, and dispute resolution procedures.

A family constitution (sometimes called a family charter) is a governance document that provides useful guidance for the family’s decision-making and functioning. Like constitutions for many public and private entities, it captures the main policies and procedures that define how the family may operate under standard and exceptional conditions. The process by which a family negotiates and decides on the provisions of a family constitution are as important as the end result of the document itself.

Typical components of family constitutions include the following:

A family constitution is not a legally-binding document. It is enforceable by the general consent of those governed by the document. Constitutions typically may be amended periodically by processes specified in its provisions.

The executive decision-making body that manages the family elements of governance in a family enterprise.

A family council – sometimes called a family board – is a family governance structure that oversees, manages, and directs activities relevant to the lives of family members.

Across generations, a family typically needs to shift from single decision-makers to having some form of rules-based decision-making that reflects the needs and desires of the extended family. Small families may first form an executive committee or council that meets to discuss and decide on matters affecting the family. Later, as the family grows in size, it may also choose to start holding family assemblies that include more members and cover a wide variety of topics.

The attributes of a family council may be defined within a family constitution or family charter, including how leadership is designated, how replacement of members occur, and how conduct is codified. Family councils often collaborate with other parts of family enterprise governance such as shareholder boards, boards of directors, the family office, and the family foundation. Elements that help define a family council versus a family assembly include the following:

The personal and family strengths, challenges, adjustment processes, communication patterns, and conflict issues related to the family, its relationships, and wealth.

The Family Dynamics domain encompasses all the individual and collective adjustment and relationship issues that factor into wealth and identity.

At the individual level, the domain includes how wealth-holders react and adjust to being wealthy, both in terms of strengths and challenges. This includes handling emotional issues within the family as well as in coping with social views, relationships, biases, and stereotypes about the wealthy. It extends to how couples handle money and wealth issues in their partner relationship, how different approaches to wealth impact committed relationships and parenting, and how adjustment issues occur over the lifespan.

At the family level, the domain covers how family members support or conflict with each other, how disputes arise and are handled, and the role of personal, social, spiritual, biological, gender, sexual orientation, and other factors in family cohesion. Strengths and challenges in communication and negotiation skills may impact the dynamics of family relationships. In addition, personal and family views about legacy, values, faith, and political orientation may impact family dynamics.

The Family Dynamics domain is a component of the Cultivation of Family Capital cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

The wide range of jointly owned or affiliated entities, assets, activities, and family members connected to a financially successful family system. These include the family itself, any family businesses or operating companies that may be present (but are not required), and all the remaining entities and governance activities of the collective family system (e.g., shared philanthropic endeavors, family offices, family councils, and shared activities of the family.

The term “family enterprise” carries some degree of confusion in the industry, being defined differently by different groups. Its roots lie in the early days of development of the family business consulting field, which partly originated in business schools and therefore maintained an emphasis on a family’s having an operating company or family business. However, as the Family Firm Institute has stated, “There is no one definition for family enterprise, but there are a few working definitions that have evolved over the years.” The UHNW Institute advocates for the following explanation:

A family enterprise includes three main elements covering the assets, entities, activities, and family members which, woven together, constitute the full family enterprise:

As indicated, some family enterprises may have never owned an operating company or family business, or the family may have sold, merged, transformed, or closed its original business, yet it still continues as a family enterprise. The enterprise includes ownership by an “enterprising family,” i.e., the family members who jointly own and oversee the family enterprise assets either directly or via trusts.

A common framework organizes the understanding of a family enterprise by various “capitals” of the family, using the acronym FISH: Financial Capital, Intellectual Capital, Social Capital, and Human Capital (Spiritual Capital is sometimes included as well). Intellectual, Social, Spiritual, and Human capitals are considered the nonfinancial capitals of the family enterprise.

In general, the family enterprise encompasses all components of the Ten Domains of Family Wealth model including the activities needed to serve the domains.

The structures, processes, and documents that relate to decision-making on the family side of a family enterprise system.

In a family enterprise, there are essentially two major systems or pillars for governance and decision-making: family governance and enterprise governance.

Family governance consists of elements such as a family council, family assembly, and/or family board. These structures oversee and manage activities related to family well-being, education, leadership, conflict management, values, and interests. There may also be collaboration and advisory oversight of shared family property (e.g., family cottages) and entities such as family foundation, other family-affiliated philanthropic activities, and possibly a family office. Participation in family governance may, depending on the family’s values and wishes, include bloodline members and/or their committed partners and spouses without regard to ownership status in the enterprise.

Common documents and processes associated with family governance include a family constitution, family charter, and other policies and procedures that support family governance.

Enterprise governance manages the complex hierarchy of assets and entities in the family enterprise system. The owners or shareholders have overall fiduciary responsibility for some combination of (potentially) a family office, holdings board, board of directors, corporate management, investment committees or managers, and the enterprise assets themselves. In enterprise governance, ownership status is relevant whereas in family governance it may not be.

In a well-known framework known as the “four rooms model” by the BanyanGlobal consulting group, the “family room” is part of family governance while the “owner room,” “board room,” and “management room” are part of enterprise governance.

Well-designed governance systems keep the responsibilities, boundaries, structures, and procedures clear and well-defined for each major element.

A wealth advisory firm, entity, or business unit established by a single family of wealth, or by or for a group of families, to manage their assets and affairs. Family offices provide a selection of personalized financial, investment, philanthropic, business, and/or other services, depending on their purpose, design, and goals.

A family office serves the unique yet complex needs of one or more UHNW families of wealth. Although a common misconception is that “if you’ve seen one family office, you’ve seen one family office,” family offices have many areas of commonality and can be sorted into understandable categories, depending on their breadth of offerings, number of families served, whether the office is part of an institutional entity, and whether a family business is present. The objective is to aggregate and coordinate the financial and other affairs of a wealthy family by assembling the right collection of resources to accomplish desired goals.

The term family office is frequently used as synonymous with single-family office (SFO), i.e., an entity designed to serve the needs of one family with very significant wealth (in the US, typically well above $100 million – $250 million USD, depending on various factors). However, there are several types of family offices, with one classification scheme including the following nine types:

The range of financial and nonfinancial activities and services that are provided by a single or multi-family office to its client(s).

Although the term family office services may seem straightforward, it is more ambiguous or confusing than is often realized, for several reasons.

First, reference to services as being of a family office level or type is entirely at the discretion of the firm type or practice setting. No standards have been developed about the criteria for who can or should call themselves a family office. For example, an RIA or wealth management firm can arbitrarily rebrand some of its service offerings to be “family office services” simply to attract more UHNW clients. This does not guarantee those services are truly suitable or helpful for UHNW clients. Also, some institutional firms may offer family-office-level services without branding themselves as a family office.

Second, just as true family offices vary widely in their scope, purposes, and structure, the services that a particular family office provides may vary widely. This may depend on the mission and goals of the families being served as well as the business model and operational structure of the office itself. A particular family office may strive to fulfill some or all of the needs described in the Ten Domains of Family Wealth model through delivery of services via in-house staff or using third-party providers. Services may include financial and/or investment management, tax planning, collaboration with trust administration, philanthropic services, risk management, family education, governance activities, family dynamics services, legacy planning, and/or lifestyle services, to name just a few.

For both these reasons, clients and other advisory firms should carefully evaluate the quality and accuracy of a particular firm’s assertion that it provides “family office services.”

A person or entity that has legal responsibility, makes decisions, and acts on behalf of another party.

Fiduciaries are legally and ethically obligated to put their client’s best interests ahead of their own. In many governance or advisory relationships, the determination of fiduciary status is central to whether the individual or entity has legally defined responsibilities and corresponding liability for decisions that are made or actions taken.

Some common examples include the fiduciary relationship between a trustee and beneficiary, where the trustee is obligated to act on the beneficiary’s behalf according to case law and the terms of the trust itself. Certain investment advisors are bound by a fiduciary relationship to their clients and must therefore select and use investments that are in the client’s best interests, not just “suitable” for the client. In contrast, broker-dealers and some other advisors may not necessarily be fiduciaries and are therefore freer to offer investments that might benefit the selling advisor more than the client.

In family enterprise governance, a board of directors might be only advisory in nature (therefore called an advisory board) without the full legal status of fiduciary responsibility. A fiduciary board has more power and responsibility for its functioning and decisions, including being liable for making decisions that damage the business it oversees.

Registered investment advisors (RIAs), attorneys, executors, investment corporations, accountants, and insurance companies all may have fiduciary duties to their clients. Whether a person has fiduciary responsibility is designated in the agreement or contract with the client.

The sum total of needs, services, and activities that form the financial wealth of the family, encompassing all financial, real estate, collectible, equity, investment, business ownership, and lifestyle assets, plus the tax planning and management related to managing those assets.

The Financial and Investment Management domain – abbreviated as the FAIM domain – covers the many traditional areas of wealth management that organize, support, monitor, adjust, and distribute wealth for an UHNW family. These include initial discovery and goal-setting to establish business and investment parameters and strategies, establishment of the complex structures and processes integrating the family’s multiple assets and needs, and ongoing monitoring and adjustment over time at both a strategic and tactical level.

The FAIM domain contains those aspects of tax planning, efficiency, and management that must be conducted within the regulatory and jurisdictional frameworks of the family and its assets.

Integration of a family’s enterprise assets are part of the FAIM domain, including the assets and financial fiduciary responsibilities for all family office, trust, operating company, philanthropic, and lifestyle assets owned or managed on behalf of family members.

The Financial and Investment Management domain is a component of the Wealth Creation and Stewardship cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

The system of rules, practices, structures, documents, and standards in a family enterprise, that guide the decision-making of each entity in the system.

Governance translates essentially to decision-making and management of a system. Family enterprises have multiple elements that require good decision-making in each part. How families approach and maintain their decision-making throughout the enterprise is a major determinant of its long-term success.

Family enterprise governance may be understood along two major lines:

Efficient and effective collaboration among the various parts of governance enhance the effectiveness of the entire family enterprise.

The design, organization, and implementation of all of the self-management and decision-making structures and processes necessary for UHNW families and family enterprises.

The Governance and Decision-Making domain covers all of the structures and processes that relate to how an UHNW family manages itself within and across generations. Governance structures include those formalized activities that manage the two core areas of family enterprise governance: the family side and the enterprise side. On the family side, typical structures include family councils, family boards, and/or family assemblies, with support from committees and programs to implement initiatives. On the enterprise side, typical structures include owners’ councils or shareholder boards, holding companies, boards of directors, management or corporate boards, and related substructures for any operating company that may be present or for other assets and investment vehicles. Governance processes include the policies and documents that help formalize how the family enterprise functions, including family constitutions, shareholder agreements, buy-sell agreements, family office policies and procedures, and the like. The domain includes governance and decision-making procedures for related entities such as family foundations, family offices, private trust companies, and any other mechanisms by which the family enterprise manages itself and its responsibilities.

A major area of responsibility in the domain is in having procedures and mechanisms in place for conflict management for both the family and the enterprise sides. Stresses and conflicts that naturally arise within a family enterprise need to be brought forth, clarified, managed, and resolved using appropriate procedures, optimally developed in advance of the problem as part of effective governance. The domain also covers those adaptations in governance and decision-making that must occur across generations as the family and its enterprise entities grow, mature, and require transformation due to internal and external circumstances.

The Governance and Decision-Making domain is a component of the Cultivation of Family Capital cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

Encompassing the intersection of physical, mental, and spiritual health, wellness, disability, and resilience related to the complexities of wealth and the family.

The Health and Well-Being domain comprises the many needs and activities of the family related to medical, psychological, and spiritual matters impacting individual and family functioning in the context of wealth and the family enterprise. Examples include the impact of dementia or disability in a family elder or leader, biological or learning factors (e.g., neurocognitive issues) affecting preparation for wealth roles or responsibilities, overseas illness necessitating emergency or concierge medical services, substance abuse by a family enterprise member, or sudden illness impacting a family transition or leadership plan. Professionals working in this domain must understand issues of wealth, confidentiality, and coordination of care management that account for unique factors such as trusts or family enterprise roles.

The Health and Well-Being domain is a component of the Cultivation of Family Capital cluster in the Ten Domains of Family Wealth model of The UHNW Institute

The range of financial net worth in the lower tier of multi-million-dollar wealth. Common lower and upper thresholds for HNW wealth are the $5 million (US dollar/USD) to $30 million (USD) range. Some usages place the upper threshold at $50 million USD.

Delineation of ranges of wealth are often used in wealth management to help define subgroups or target services. Definitions of wealth levels typically focus on “investable net worth, exclusive of primary residence.” Investable net worth also may exclude illiquid but very significant assets such as the value of a privately held business. Many wealth management firms prefer to distinguish a client’s overall net worth (including business ownership) from only those investable assets available for management by the firm. HNW is sometimes used to denote a minimum level of investable assets that qualifies a client for the purchase of certain investments.

Although there are no official standards for different ranges, there are common terms representing similar groups. The mass affluent range is often defined as the $1 million USD – $5 million USD range (sometimes called “the millionaire next door” after the 1998 book of the same name). HNW is the next level up, from $5 million USD to either $30 million or $50 million. Capgemini, a wealth consulting and research firm, also defines this level as “mid-tier millionaires.” Ultra High Net Worth (UHNW) is the next level, extending from at least $30 million into the billions.

Note that these ranges and thresholds have been established since at least the 1990s when a $1 million USD net worth represented someone at the 99th percentile economically in the US. With inflation and demographic changes, these levels may no longer suffice. The term centimillionaire has begun to be used to designate the range from $100 million to $1 billion. This recognizes the unique characteristics, needs, and service requirements that families in this increasingly prevalent range have. Clients with $1 billion USD or more would properly be considered billionaire families.

The terms High Net Worth individual (HNWI) or High Net Worth family (HNWF) denote the holder(s) or beneficiary(ies) of this wealth.

A wealth advisory firm that serves as an integrator of services for one or more of its client families. The firm may provide the majority of services using its own staff or it may oversee some services provided by external advisors.

An integrated wealth advisory firm serving as the hub in a hub-and-spoke service delivery model provides both a significant number of services across the Ten Domains of Family Wealth and the valuable integration function that elevates the quality of service delivery for its clients. Within the integrated advisory hub, one or more skilled advisors possess the skills of the expert generalist or integrated family wealth advisor to coordinate, oversee, foster collaboration, and maintain accountability for excellent service delivery across multiple domains. This process may require developing strong relationships with specialist service providers who operate in the spoke domains of the hub-and-spoke model.

Integrated advisory hubs must have the optimal level of skills in the Family-Advisory Relationships domain as well as system-wide capacities for integration, including the leadership, technology, talent management, and practice management qualities that support integrated services.

A family wealth advisor with the advanced interdisciplinary knowledge and skills to act as an integrator and team leader in the delivery of services for an UHNW client family.

An integrated wealth advisor is a family wealth advisor who has developed greater competency for integrating family office services and the work of other advisors. The integrated wealth advisor – also termed an expert generalist – goes beyond specific technical disciplines in UHNW wealth management to put the client family’s goals and objectives first, with true client-centered services. This advisor ensures that all specific disciplines are responding to and integrated with those goals and that the family’s best interests are being consistently met. The integrated wealth advisor tries to anticipate how one decision might affect another and that the implications of one activity are understood and incorporated in others.

The role requires excellent project management skills as well as a broad understanding of quality service delivery across multiple domains and disciplines. It therefore requires support from leadership in the organization as well as ongoing training and the alignment of compensation and business models to avoid conflicts of interest or goals. Integrated wealth advisors are often found in firms and family offices who handle more complex patterns of integration and who seek to function as an integrated hub in service delivery.

The most complex model of family office services, covering the full range of financial and nonfinancial services needed by an UHNW family using an integrated approach.

Integrated family wealth management is the most comprehensive approach to family office services. It covers all Ten Domains of Family Wealth through some combination of in-house and external advisors, plus at least one integrated family wealth advisor or team to manage and integrate the delivery of services across all domains. The hallmark of this type of wealth advisory services is the breadth, depth, and integration of services available to the client family over the course of their lives.

Integrated family wealth management may be implemented through various advisory business models, including the following:

A less complex model of wealth advisory services may involve an integrated hub serving all of the Wealth Creation and Stewardship cluster domains but only a limited number of Cultivation of Family Capital cluster domains, often through arm’s-length referral relationships that are less closely monitored or managed.

The consistent process of coordinating and delivering client services across multiple domains to achieve optimal outcomes.

Integration of family office services brings together internal and/or external service providers across some or all of the Ten Domains of Family Wealth to achieve a variety of benefits for clients and firms. It goes beyond basic cooperation (which is task-specific) or even skilled collaboration among providers (which is situation-specific) to add elements of leadership, team process, and consistent project management.

In an integration process, service providers work together effectively on behalf of the client, appropriately sharing information within proper bounds of confidentiality and privilege. There needs to be at least one integrated wealth advisor or expert generalist on the team who oversees the integration process to maintain accountability and keep projects on track. The central advisory firm – a hub provider in a hub-and-spoke network – must also implement organizational, technology, provider compensation, and management factors to support integration. As is often seen in healthcare integration, the process becomes a mindset and systemic approach rather than a set of collaborative behaviors for a given situation. In addition, the client family needs to understand, support, and be willing to pay for integrated services.

There are currently no standards in the industry for what constitutes integration of services. The UHNW Institute is currently developing a framework and guidelines to organize services into verifiable patterns of integration so firms and clients can have clarity about the process.

The needs and activities related to the family’s coping with, developing strategies for, implementing, and regaining equilibrium after common multigenerational transitions, including the specific activities for supporting transitions across time in the leadership of the family and its family enterprise.

The Leadership and Transition Planning domain focuses on two main types of experiences that can stress an UHNW family and/or its family enterprise. One is the broad range of common transitions that a family must navigate: generational, aging, entrances and exits of family members, changes in financial fortunes or status, and changes in the governance or decision-making of the family. The other area encompasses the many strategies and plans involved in leadership development, succession, and transition in family governance (e.g., family councils) and family enterprise governance (e.g., owner councils, boards of directors). These activities may include personal assessment, leadership development, coaching, and succession management for those transitioning into and away from key positions.

Knowledge and skills needed in the Leadership and Transition Planning domain cover both general areas (e.g., knowledge of common stages of change or reactions experienced during major personal or family transitions) and specific areas (e.g., how to implement transition planning in C-suite leadership of a major family enterprise or the family office) of expertise.

The Leadership and Transition Planning domain is a component of the Cultivation of Family Capital cluster of the Ten Domains of Family Wealth model of The UHNW Institute.

The many needs and activities involved in fostering the growth, development, parenting, education, and training of individuals and families across the lifespan of a multigenerational UHNW family.

The Learning, Development, and the Rising Generation domain encompasses the personal, family enterprise, and family system activities that foster, support, and educate family members at all life stages, accounting for learning styles, decision-making roles, and positions within family, ownership, and business relationships.

Although this domain is often thought of primarily as financial education of children in a family of wealth, the domain is much broader. It covers all members of the family across the lifespan, including spouses and partners entering the family through committed relationships, elders undergoing life transitions, and stepfamilies having to learn knowledge and skills when joining the family. It also covers the multiple roles and responsibilities that require education such as becoming shareholders, beneficiaries of trusts, members of boards, and clients of a family office. These parenting, education, training, and personal development activities must account for learning styles or other issues that may impact the process of education or training. Families may provide support for learning programs either at the individual level or in family-wide programs supported by family governance and its leadership.

The Learning, Development, and the Rising Generation domain is a component of the Cultivation of Family Capital cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

A for-profit comprehensive wealth advisory firm or business unit that caters to Ultra High Net Worth (UHNW) individuals and unrelated discrete families. MFOs offer a range of services from narrowly focused on financial and investment matters to a wide range of financial and nonfinancial services.

The term “multi-family office” or MFO is widely used in the wealth management industry but has not yet been precisely defined with accepted standards. Some industry observers believe the term has no established basis and should never be used. Most professionals simply recognize that the term has had growing recognition over the past thirty years, even if there is inadequate validity or consistency in its use.

In more responsible firms, the primary goal of an MFO is to provide integrated and personalized wealth management services that align with the long-term objectives and priorities of UHNW individuals and their families. MFOs typically have multidisciplinary professional staff (e.g., CPAs, CFPs, CFAs, JDs) who demonstrate professional competencies and have the experience required to serve this level of wealth appropriately. Many but not all MFOs rely on managing investments for the family and derive investment management fees to subsidize the additional services which some families may or may not utilize.

There are various business and service delivery models for MFOs. These models include having all services fully delivered in-house, some services available on referral to external vendors or providers, or a network-type hub-and-spoke model where a majority of core services are offered in-house while outsourced services are integrated via the MFO advisor or advisory team. Some wealth advisory firms provide the same services that an MFO offers but do not identify themselves as a multi-family office.

Family Wealth Alliance (FWA) has proposed four standards for what defines a true MFO. These include the following:

1. The nature of the clientele – at least ten complex multigenerational client family relationships with a median of $30 million net worth, within a firm with at least $1 billion AUM.

2. The services that are offered – ten core services offered in an integrated service delivery model.

3. The nature of the service delivery – client-centered; transparent in fees, products, and service relationships; fully regulatory compliant; no conflicts of interest; customized; a definable consistent process for working with outside providers.

4. Experience – minimum three-year existence; credentialed staff; stability in ownership and management; involvement with the professional field.

Although these standards are well-grounded and often cited by The UHNW Institute and other organizations, they are not required for a firm to call themselves an MFO. This allows a wide variety of wealth management firms at the High Net Worth (HNW) and UHNW levels to advertise they are “a multi-family office” to attract clients and compete in the marketplace.

The different methods by which family office services may include activities within the Ten Domains of Family Wealth for effective service delivery.

There are currently no accepted standards for what constitutes “integrated family office services” for the complexities of wealth. The choice to describe services as being integrated is largely at the discretion of the advisory firm or family office.

The UHNW Institute is engaged in an initiative to help define potential patterns of integration in a verifiable manner for use by firms/family offices and client families. In its current state of development, these patterns may involve at least four options:

1. Single or siloed delivery of services in one or two domains by specialist service providers.

2. Combining a few areas or domains of service delivery, often primarily in the financial and wealth transfer areas. This may be termed integrated financial management.

3. Integration of services utilizing all four domains in the Wealth Creation and Stewardship cluster of the Ten Domains of Family Wealth, plus a limited number of services within the Cultivation of Family Capital cluster such as family dynamics, governance, and/or family education. This may be the realm of integrated wealth management.

4. The most complex pattern of integrated service delivery across the entire Ten Domains of Family Wealth, led with expertise by at least one integrated family wealth advisor or trusted team. This would be the level of integrated family wealth management.

Each firm must determine its best structure based on its skills, mission, talent, organizational structure, position in the industry, and business model. Standardizing patterns of integration is designed more for eliminating confusion for families coping with the marketplace and for family offices making strategic decisions about their service offerings.

A specialist service provider who helps clients navigate the design, use, and implementation of resources for philanthropy and social impact.

Also: philanthropy advisor or philanthropic consultant

Philanthropic advising is an evolving field with a wide range of skills, services, and competencies among professionals who offer services. Such services may include helping clients define philanthropic purpose, plan charitable and legacy gifts, choose and establish philanthropic vehicles, design strategies for charitable giving or social impact, identify opportunities and carry out plans, evaluate impact, and identify other aligned funders or learning partners. In addition, some philanthropic advisors have skills in other domains in the Cultivation of Family Capital cluster and can serve integrative roles within the Family-Advisory Relationships domain.

Currently, there is one recognized credential in this area – the Chartered Advisor in Philanthropy (CAP) designation – which has somewhat limited scope. Other credentials or designations are being developed, but the field may be considered still in its infancy as an organized profession. Many philanthropic advisors possess education, training, and credentialing in other disciplines related to law, wealth management, accounting, governance, or family dynamics. They may or may not obtain a CAP designation. Family office and other UHNW advisors and clients may wish to clarify the expertise and experience of specialist service providers identifying themselves as philanthropic advisors.

The needs, services, and activities related to all family risk education and management, including board, company, or trustee roles; reputational risk; staff management; family/residential/cyber security; emergency preparedness; risks of high-value assets of residences/collections/aviation/luxury yachts; and holistic insurance strategy.

The Risk Management domain encompasses all areas of an UHNW family’s personal, business, and wealth management and activities that require careful analysis, oversight, planning, and protection for liability, privacy, and security. Traditionally, this domain was seen primarily as the realm of insurance planning and management. As families and their enterprise assets have grown more complex in an increasingly litigious and risk-laden environment, the domain has expanded significantly and requires holistic planning and management to be effective. Consistent with this, modern risk management requires the active knowledge, education, and participation of the family in assessing and managing its privacy, security, and liability risks.

The Risk Management domain is a component of the Wealth Creation and Stewardship cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

An individual professional or professional services firm with focused expertise in a specific discipline associated with family wealth advising.

Specialist service providers may range from accounting or legal firms serving UHNW families or family offices to individual or group consulting firms in any of the Ten Domains of Family Wealth. Given the particular skills and experience required to provide a service that not all UHNW clients may want or need at a particular time, many larger wealth management firms may choose not to have this expertise on staff. Rather, they will seek to partner with or refer to a specialist service provider when the need arises. The specialist provider may then be contracted with and paid directly by the client or by the referring wealth management firm or family office.

In integrated family wealth management, a specialist service provider may be accessed upon referral by the integrated hub advisory firm or through a more formalized strategic partnership agreement that facilitates collaboration and integration.

The charitable, investment, and philanthropic activities designed to foster personal and social benefits, impact the world, and promote the values of a family of wealth and/or its family enterprise.

The Social Impact and Philanthropy domain encompasses the many financial and nonfinancial charitable, philanthropic, social impact, and community activities of the family, including foundations and other vehicles by which families may choose to create impact in the world based on their values and goals. These activities may be relatively limited and primarily driven by tax efficiencies or estate planning considerations. Alternatively, they may be woven throughout the family’s entire investment, business, and social activities through impact investing, advocacy of particular causes, and involvement in political, social, spiritual, or environmental initiatives.

Effective impact and philanthropic services may include consideration of family dynamics, education, governance, investment, wealth transfer, and generational engagement and leadership.

The Social Impact and Philanthropy domain is a component of the Wealth Creation and Stewardship cluster in the Ten Domains of Family Wealth model of The UHNW Institute.

A specialist professional service provider offering services to an UHNW client via a referral or contractual relationship with the client’s primary advisory firm.

In a common hub-and-spoke advisory network model of service delivery, a provider or specialist firm may work with a client family regarding one or more services in a domain within the Ten Domains of Family Wealth model. The family may seek out the specialist provider on its own or it may request that its family office or primary advisory firm (the “hub”) recommend or find the specialist provider for the client.

The family office or firm has choices in how it assists a client family with obtaining specialist services. It can simply help the family understand the nature of those services so the family can perform a search on its own. It can help recommend services through making referrals to one or more providers in an arm’s-length relationship whereby the client contracts and pays for the specialist services independently. Or, the hub firm may offer to its clients a short list of specialist providers with whom the firm has a known history, vouches for the quality of service, and may have a preferred-provider contractual relationship or strategic partnership.

Relationships with spoke providers in a strategic partnership are the most integrated and collaborative of connections for the client. However, there are also a range of benefits, risks, and pricing issues involved in the type of relationship between the hub firm and the spoke provider.

A comprehensive framework for understanding the needs and issues facing UHNW families across generations. Each domain represents an area in which UHNW clients and families require services from their advisors, family offices, and other wealth advisory professionals.

The Ten Domains of Family Wealth model was the first major framework developed by The UHNW Institute to advance thinking about the field. Initially developed in early 2020, the model was further refined and updated in late 2022 for its current configuration.

The Ten Domains model takes a novel approach to understanding families of wealth and family enterprises. Traditionally, wealth-management strategies have relied on organizing the needs of a family based largely on the services that can be delivered by advisors, potentially biasing recommendations in favor of the advisory firm rather than the family. In contrast, the Ten Domains model analyzed and organized the needs of families independent of whatever a particular advisory firm might provide for service. This allowed a clean-sheet design that prioritized a balance of needs and services without favoring any individual domain. It also elevated the importance of interdisciplinary knowledge and skills in all technical services to create the most effective relationship between a client family and its advisors. By placing these traditionally secondary “soft skills” at the core of all technical areas, the Ten Domains model emphasized the importance of how services are delivered as much as what services are delivered.

The Ten Domains of Family Wealth include the following domains (see image):

The UHNW Institute continues to refine the Ten Domains of Family Wealth model through initiatives focused on integrated family wealth management, understanding phases of service delivery, practice management issues, and types of advisory firms that offer services in various domains.

An advisory role that emphasizes developing a central position of trust and influence with the client.

The concept of “trusted advisor” was developed in the late 1990s – early 2000s era of financial planning and wealth management by several prominent advisors as an outgrowth of the life planning movement. First outlined in the book The Trusted Advisor (2000), it was expanded upon in several subsequent books and articles. The role of a trusted advisor emphasizes achieving “first call” status where a client chooses the trusted advisor as the initial point of contact and problem-solving for most issues that arise. This position reflects the level of trust and confidence the client has in the advisor above other advisors the client may have.

Maister, Green, and Galford, authors of The Trusted Advisor, described three core skills for the role: being able to earn and deserve the client’s trust, being able to give advice based not only on rational problem-solving but also a sensitive understanding of the client’s entire situation, and the ability to build a thoughtful considerate relationship with the client. They advocated for a variety of empathic client relationship skills that foster a strong bond.

Over time, the concept of achieving “trusted advisor” status has become associated with achieving gatekeeping status over all other advisory relationships the client may have – a financially and relationally powerful position. It endows the trusted advisor with discretion over how problems are solved, who else gets to work with the client, and what the client may access for alternative resources. Jockeying for position as the client’s trusted advisor can impact the degree to which advisors are protective of the client relationship, supporting or impeding collaboration and integration efforts by other advisors of the client. Also, as the complexity of wealth at the UHNW level has continued to advance, a single trusted advisor may no longer be able to understand, offer, or coordinate the many domains of family wealth. The role of the trusted advisor may therefore be transitioning to the role of the “trusted team” as a more effective method of serving a modern client family of significant means.

A collaborative group of advisors that works together to fulfill most of the needs and services of an UHNW client family.

The concept of a “trusted team” is an outgrowth of the longstanding role of the “trusted advisor” in wealth management and family office services. First outlined in the early 2000s and subsequently expanded throughout the financial services industry, the role of the trusted advisor has become touted less for its excellent client relationship skills and more for its central position of influence and gatekeeping with the client. The aim is to achieve “first-call” status where the client turns to the trusted advisor for whatever needs to be done, thereby controlling access and utilization of other advisory services.

With the growing recognition of the complexity of client needs across the Ten Domains of Family Wealth, especially for UHNW families, there has been increased awareness that one trusted advisor may no longer be sufficient to understand or oversee all that is required to serve the family well. The downsides of the trusted advisor role are also increasingly apparent in the jockeying for position and lack of collaboration that can occur when an advisor seeks to own the client relationship.

A more realistic and effective role for the complexity of modern UHNW wealth may be the “trusted team” concept. Led by an expert generalist or integrated wealth advisor with excellent collaboration skills, the trusted team consists of a small group of highly skilled advisors from various professional disciplines who can operate in an interdisciplinary manner to evaluate and help implement solutions for the client family. This places less of a burden on a single advisor to know and serve the client effectively while also fostering the kind of integrated services a client family may need. While a trusted advisor may still be helpful or appropriate for specialist service providers or highly focused services in a few related domains, the trusted team concept may be more necessary as the levels of integration increase to encompass a greater number of services.

The range of financial net worth at the highest tier of wealth. One common threshold for UHNW wealth is $30 million (US dollars), ranging upwards to the billions.

Delineation of ranges of wealth are often used in wealth management to define subgroups or target services. Many firms prefer to distinguish a client’s overall net worth (including business ownership) from only those investable assets available for management by the advisory firm.

Although there are no universally accepted standards for different ranges, there are common terms representing typical groups, denoted in US dollars (USD). The mass affluent range is often defined as the $1 million USD – $5 million USD range (sometimes called “the millionaire next door” after the renowned 1998 book of the same name). High Net Worth (HNW) is the next level up, from $5 million to either $30 million or $50 million USD. Capgemini, a wealth consulting and research firm, also defines this level as “mid-tier millionaires.” Ultra High Net Worth (UHNW) is the highest level, extending from at least $30 million USD into the billions.

With inflation and the significant expansion of global wealth since 2000, more firms are considering the modern threshold to the top UHNW level to be $100 million USD, or the centimillionaire level. This rarefied level is also variously referred to as “superwealthy” or “uberwealthy,” but these terms are more colloquial and risk having a pejorative meaning about the very rich. The delineation of families with greater than $100 million USD net worth legitimately discriminates their unique needs, complexity, and multigenerational planning requirements compared to lesser levels of wealth.

The terms Ultra High Net Worth individuals (UHNWIs) or Ultra High Net Worth family (UHNWF) denote the holders or beneficiaries of this wealth.

A team, practice, firm, or business unit that serves the needs in most but not all nine content domains in the Ten Domains of Family Wealth model using a combination of internal and external resources. It does not necessarily perform the activities of integrating service delivery in those domains.

In The UHNW Institute’s Advisory Business Model classification framework, the roles and service relationships of advisory firms are delineated according to their service focus (domains served) and pattern of integration with other firms and providers.

Those with a Wealth Advisory business model focus on a broad menu of services for client families. Some firms cover all four domains in the Wealth Creation and Stewardship cluster and most but not all five domains in the Cultivation of Family Capital cluster. Other firms provide services in all Family Capital domains but not all of the Wealth Creation and Stewardship domains. Using various approaches, these firms provide services through some combination of in-house individuals or teams plus external resources, either on referral or through more collaborative strategic partnerships.

What Wealth Advisory firms lack is the ability to integrate those services as fully as possible. The firm may not have the staff, skills, or operational setup necessary for fully integrated family wealth management, including the services of at least one integrated family wealth advisor or expert generalist to help lead the team and the client family engagement. Firms with those capabilities and staff fulfill the criteria for having a Family Wealth Advisory business model.

One of the two clusters of domains in the Ten Domains of Family Wealth model of The UHNW Institute. The four components in this cluster include:

The Wealth Creation and Stewardship cluster encompasses the domains typically associated with traditional or technical aspects of family office services. These focus on the family’s financial wealth, business ventures, wealth transfer, tax planning, charitable giving, insurance, and risk management. For many advisory firms, service delivery in these areas represents the core areas of wealth management or family office services.

The domains in the Wealth Creation and Stewardship cluster are increasingly seen as only part of what is needed by an UHNW family. The nonfinancial needs and activities of the family are increasingly recognized as crucial for truly integrated family wealth management over the long term. These nonfinancial needs are defined within the Cultivation of Family Capital cluster in the Ten Domains of Family Wealth model.